David is one of the earliest writers for Torchlight, and also pinch hits on website support and editing/posting. He holds a PhD in Economics, which with $5 would get him a latte; sadly, he doesn’t even like coffee. He can be reached at dspitzley@torchlightmedia.net.

Footnotes

- http://www.epi.org/publication/charting-wage-stagnation/, Figure 4

- https://torchlightmedia.net/lampposts/unemployment-statistics/

- https://en.wikipedia.org/wiki/Luddite

- http://www.pwc.co.uk/services/economics-policy/insights/uk-economic-outlook.html

- National Bureau of Economic Research, the non-profit organization best known for publishing the official estimates of the start and end dates for recessions.

- Unfortunately, NBER working papers are only available for free to people with government or university email addresses, journalists, and residents of developing countries.

- Acemoglu and Restrepo, p. 2

- The IFR's publishes World Robotics every year, which contains detailed statistical data for 50 countries, broken down by technologies, industries, and other technical and economic variables.

- The technical term for this is called an Instrumental Variables model, substituting one set of data (i.e. international trends in adoption of robots in an industry) for one it is highly correlated with that comes with statistically undesirable correlations to yet other variables (i.e. local market adoption of robots being influenced by local union action/tax policies/educational investment/etc.)

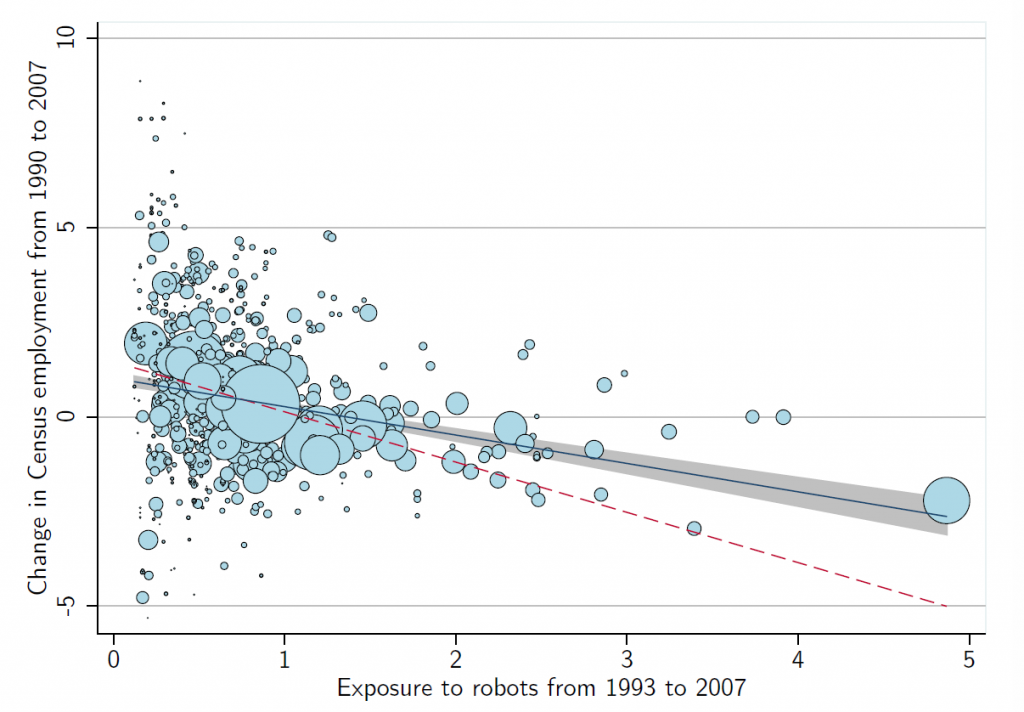

- Acemoglu and Restrepo, p. 28

- Acemoglu and Restrepo, p. 36